Homeownership isn’t just a roof over your head—it’s a cornerstone of wealth-building, particularly for the Hispanic community. As the Hispanic Wealth Project™ outlines, homeownership is one of the most effective pathways to narrowing the wealth gap and fostering generational financial security. In fact, owning a home can significantly multiply household wealth, enabling families to thrive for generations.

Homeownership: The American Dream and Beyond

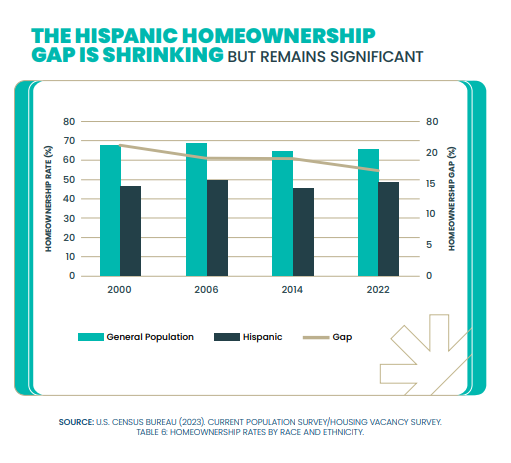

Owning a home is a classic symbol of the American Dream, representing stability, pride, and accomplishment. But its impact goes deeper. According to the 2024 State of Hispanic Wealth Report, the median net worth of Hispanic homeowners is $233,100, over 26 times higher than Hispanic renters. This wealth stems largely from home equity—a reliable, appreciating asset that serves as a financial foundation for future investments, education, or business ventures.

Building Wealth Through Real Estate

For many Hispanic families, homeownership isn’t just about having a place to call their own—it’s about building an ecosystem of financial growth. The equity gained from homeownership often acts as a springboard for other investments, including real estate. Hispanic buyers are entering the market earlier, with nearly 45% of Latino homebuyers under age 35.

Moreover, the Hispanic Wealth Project aims to increase the rate of Hispanic investment property ownership by 25%. By investing in real estate beyond primary residences, families can diversify their income and build even greater financial resilience.

NAHREP Discipline: Be Politically Savvy

One key to unlocking these opportunities is understanding the policies that shape access to homeownership. Advocating for affordable housing policies, first-time buyer incentives, and equitable mortgage practices can open the door for more Hispanic families to enter the housing market. This aligns with NAHREP’s discipline to “Be Politically Savvy” by staying informed about legislation that impacts wealth-building opportunities.

Your Partner in Real Estate Wealth

Whether you’re purchasing your first home or expanding into investment properties, having the right guidance is essential. Mark Pinilla, an expert in real estate and investment properties, can help you navigate this journey. Reach out to Mark at markpinilla.com to take the next step toward financial freedom.

Additional Resources:

Get more information on Property Management

Get more information on Real Estate

#HispanicWealthProject #SustainableGenerationalWealth #WealthBuilding #Homeownership #NAHREP10 #TrainersInAction #EducacionFinanciera #LatinoWealth #Finhabits #RaicesyRiquezas #FinancialLeadership #GenerationalWealth #MarkPinilla